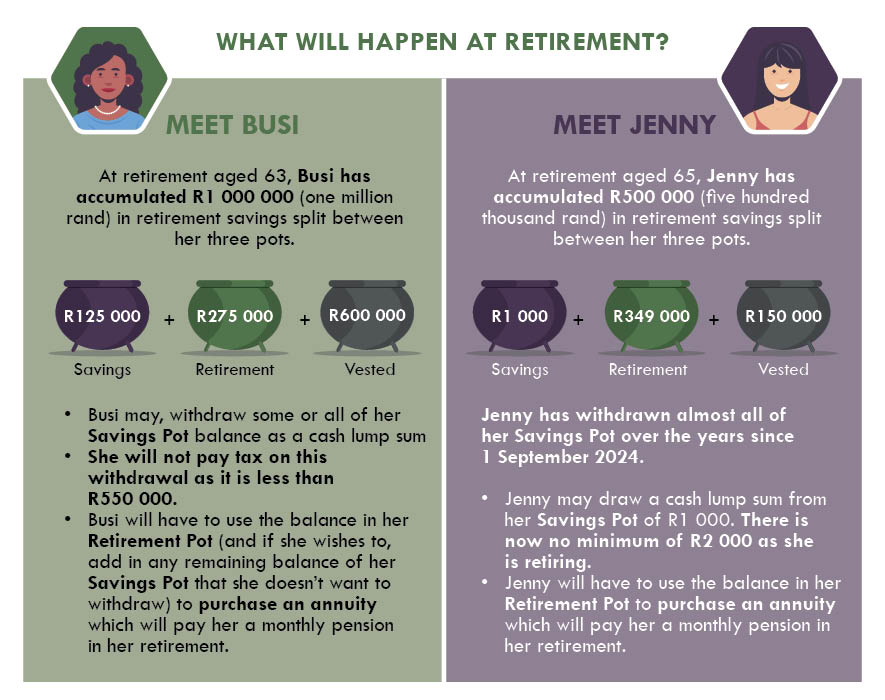

At retirement, you will be able to withdraw the balance of your Vested Pot as well as any balance in your Savings Pot as a cash lump sum. You will be taxed if the total amount of this withdrawal is greater than R550 000.

The balance in your Retirement Pot must be used for “annuitisation” - this means the balance in your Retirement Pot will be used to buy a monthly pension from a life insurer, and you will receive a monthly payment called an annuity or pension from that life insurer during your retirement.

For Provident Fund Members: If you were a member of a Provident Fund on 1 March 2021, there may be elements of your Vested Pot which will require to be added to your Retirement Pot to purchase an annuity on retirement.